In today’s fast-paced market, staying ahead of the curve is crucial for investors. Stock monitoring has become an essential tool for tracking market opportunities and predicting when deals will go live.

With the right platform and alerts, investors can react quickly to changes in stock levels and capitalize on market movements. By leveraging real-time updates and data, investors can anticipate price drops and limited-time offers before they’re publicly announced.

This comprehensive guide will explore the connection between inventory levels and deals, and provide insights on how to set up an effective stock monitoring system.

Key Takeaways

- Understand the importance of stock monitoring in predicting deals.

- Learn how to set up alerts for real-time updates on inventory levels.

- Discover the right tools and platforms for effective stock tracking.

- Gain insights into anticipating price drops and limited-time offers.

- Implement a stock monitoring strategy to stay ahead in the market.

Understanding Stock Monitoring for Deal Prediction

Stock monitoring is a crucial strategy for predicting when deals go live, allowing savvy shoppers to stay ahead of the curve. By keeping a close eye on inventory levels, consumers can gain valuable insights into upcoming sales and promotions.

The Connection Between Inventory Levels and Deal Availability

Inventory levels often serve as a precursor to deal availability. When stock levels fluctuate, it can signal an impending sale or promotion. Real-time stock tracking enables shoppers to monitor these changes as they happen, providing a significant advantage over those who rely on deal announcements.

Many limited-time offers and flash sales are preceded by specific inventory movements that can be detected through careful stock tracking. By analyzing these patterns, deal hunters can anticipate when a sale is about to occur.

Why Real-Time Stock Monitoring Gives You a Competitive Edge

Real-time stock monitoring provides immediate updates on inventory changes, giving shoppers a head start on purchasing products at discounted prices. This capability is particularly valuable in fast-moving markets where deals can sell out quickly.

With stock alerts platforms, consumers can receive notifications about sudden changes in inventory levels, which often precede special offers or discounts by hours or even days. By being among the first to know about these changes, shoppers can prepare for upcoming deals and act swiftly when they go live.

By leveraging real-time updates and market movements, sophisticated deal hunters can predict when prices will drop. This proactive approach to deal hunting allows consumers to stay ahead of the competition and make informed purchasing decisions.

The Benefits of Monitoring Stock Levels in Real-Time

Monitoring stock levels in real-time can significantly enhance your ability to catch deals before they sell out. By keeping a close eye on inventory changes, you can anticipate and react to upcoming promotions or discounts. This proactive approach gives you a competitive edge in the market.

Catching Limited-Time Offers Before They Sell Out

Limited-time offers are designed to create a sense of urgency, but with real-time stock monitoring, you can capitalize on these deals before they expire. AI and machine learning technologies analyze historical data and current trends to forecast demand, enabling you to anticipate inventory needs. By tracking stock levels, you can identify when a product is about to go on sale, allowing you to make informed purchasing decisions quickly.

Successful deal hunters rely on identifying recurring patterns in how retailers manage their inventory before launching promotions. By analyzing these patterns, you can stay ahead of the competition and snag the best deals.

Identifying Patterns in Inventory Changes That Signal Upcoming Deals

Many retailers follow consistent inventory management practices before major sales events, making historical data analysis crucial for recognizing these patterns. Common signals include a gradual inventory build-up followed by a sudden increase, often preceding a planned promotion or clearance sale. Sophisticated stock tracking systems can automatically identify these patterns by analyzing historical inventory data and alerting you to similar conditions.

By monitoring multiple similar products across different categories, you can reveal broader trends that indicate company-wide sales rather than single-item discounts. The insights gained from pattern recognition in inventory changes allow you to anticipate deals days or even weeks before they’re officially announced.

Essential Features of Effective Stock Monitoring Tools

Effective stock monitoring is crucial for predicting deal availability, and the right tools can make all the difference. To stay ahead, it’s essential to understand the key features that make a stock monitoring tool effective.

Real-Time Data Updates and Notifications

Real-time data updates are vital for tracking current stock levels and predicting when deals might go live. Tools that provide instant notifications when stock levels change or when certain conditions are met can give users a significant edge. By leveraging real-time data, users can react quickly to changes in inventory, increasing their chances of snagging limited-time offers.

Historical Data Analysis Capabilities

Analyzing historical data is equally important, as it allows users to identify patterns and trends that can inform their predictions about future deals. By examining past inventory patterns, users can gain valuable insights into how retailers manage their stock. Historical data analysis capabilities enable users to compare current stock levels with past instances when deals were offered, providing context that helps in making informed predictions.

Some of the key features to look for include the ability to visualize historical data through graphs and charts, making it easier to spot patterns that might not be obvious in raw numbers. Advanced platforms use machine learning to analyze historical stock and price data, automatically identifying patterns that might indicate upcoming deals. Additionally, the ability to export historical data for custom analysis and to annotate it with notes about past deals can be particularly valuable.

Top Stock Monitoring Platforms for Deal Hunters

For deal hunters, staying ahead of the curve requires the right tools, and stock monitoring platforms are at the forefront of this hunt. These platforms offer real-time data and alerts that can make all the difference in catching a deal before it sells out.

ChartsWatcher

ChartsWatcher is a robust stock monitoring platform that provides users with real-time stock alerts and comprehensive charting tools. Its customizable features allow users to tailor the platform to their specific needs, making it a valuable tool for deal hunters.

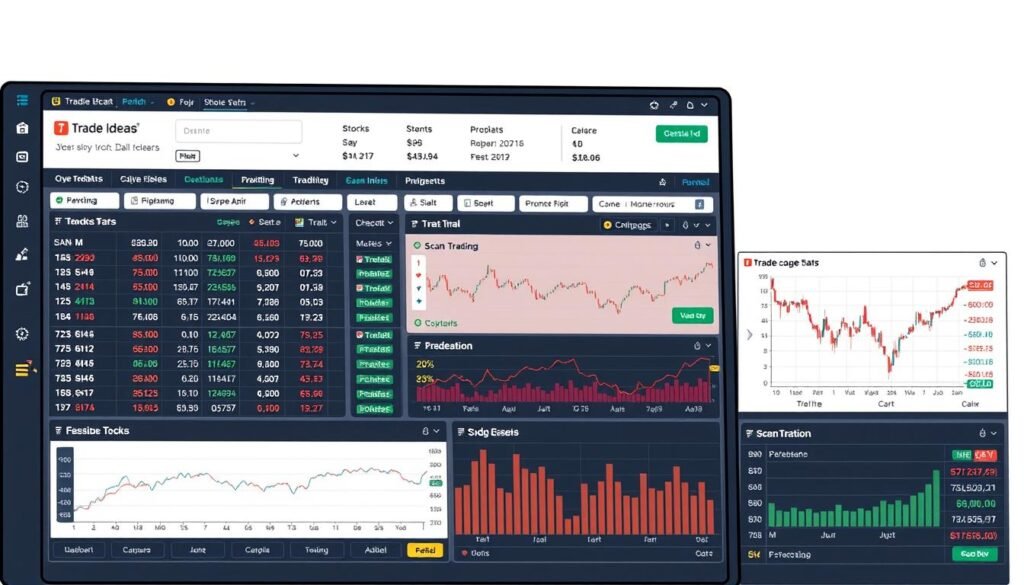

Trade Ideas

Trade Ideas is a powerful stock monitoring software that offers real-time data and customizable alerts. Its advanced scanning capabilities allow users to identify potential trading opportunities quickly, making it an excellent choice for those looking to stay ahead in the market.

TradingView

TradingView is renowned for its real-time stock alerts and comprehensive charting capabilities. It offers a community-driven platform where users can share insights and ideas, making it a great resource for deal hunters looking for both data and community feedback.

Thinkorswim by TD Ameritrade

Thinkorswim by TD Ameritrade stands out as a comprehensive trading platform that offers highly customizable real-time stock alerts. Its proprietary scripting language, thinkScript, allows users to create highly specific custom scans and alerts, making it a powerful tool for serious deal hunters.

Key Features:

- Comprehensive stock monitoring capabilities

- Highly customizable real-time alerts

- Robust technical analysis tools

- Integration with news alerts for context on inventory changes

- Paper trading environment for testing strategies

Stock Monitoring, Real Time Updates, and Quick Action: The Perfect Trifecta

The key to successful deal hunting lies in the trifecta of stock monitoring, real-time updates, and quick action. By combining these elements, you can significantly enhance your ability to capitalize on emerging deals.

Setting Up Automated Alerts for Inventory Changes

To start, you need to set up automated alerts for inventory changes. This involves choosing a reliable stock monitoring platform that offers real-time data updates and customizable notifications. Developing a prioritized action plan for different types of alerts is crucial, so you know exactly what steps to take when notifications arrive. Consider keeping payment information, shipping addresses, and account logins ready to minimize checkout time when deals go live.

Creating a Quick-Response System for When Alerts Trigger

Creating a quick-response system is essential for capitalizing on the information provided by your stock monitoring alerts. This includes using autofill tools or password managers to speed up the purchasing process, creating bookmarks or shortcuts to specific product pages, and setting up multiple devices to receive alerts for high-priority items. Testing your response system periodically with timer drills helps identify and eliminate bottlenecks in your process. By having a well-organized system in place, you can ensure that you’re always ready to take quick action when opportunities arise.

Advanced Stock Alert Applications for Serious Deal Hunters

In the competitive world of deal hunting, having the right advanced stock alert applications can make all the difference. Serious deal hunters need tools that not only provide real-time data but also offer sophisticated analysis to predict stock level changes and potential deals.

Benzinga Pro for Market-Moving News and Stock Alerts

Benzinga Pro is a powerful tool designed for those who need timely market-moving news and stock alerts. It provides real-time news and analysis that can impact stock prices, helping deal hunters stay ahead of the curve.

LevelFields for AI-Driven Stock Event Analysis

LevelFields leverages AI-driven analysis to scan millions of events that impact stock levels and prices. This helps deal hunters identify potential sales opportunities before they’re widely known. The platform tracks over 6,300 companies and analyzes how specific events affect stock levels and pricing.

- Offers real-time volume spike and volume dip alerts based on targets and event triggers.

- Provides pattern-based price reaction analysis to guide users on when to expect deals.

- Saves time by eliminating the need for manual charting and lengthy research.

By utilizing these advanced stock alert applications, serious deal hunters can gain a competitive edge. Whether it’s through Benzinga Pro’s market-moving news or LevelFields’ AI-driven event analysis, having the right tools is crucial for success in the fast-paced world of deal hunting.

Free vs. Premium Stock Monitoring Tools: What’s Worth Paying For

When it comes to stock monitoring, the choice between free and premium tools can significantly impact your deal hunting success. Stock monitoring tools are essential for identifying potential deals, and the right choice depends on your specific needs and investment goals.

Capabilities of Free Stock Alert Services

Free stock alert services can be a good starting point for casual deal hunters. These services often provide basic features such as price drop alerts and stock availability notifications. However, they may lack advanced features like real-time data updates, sophisticated pattern recognition, and multi-source integration. For example, free services might not offer the ability to track products across multiple retailers simultaneously or provide historical data analysis. Despite these limitations, free stock alert services can still be useful for monitoring low-value or non-competitive items.

Key features to look for in free stock alert services include: customizable alerts, real-time data (even if delayed), and compatibility with multiple retailers. While free services have their limitations, they can be a valuable addition to your deal hunting toolkit, especially when used in conjunction with premium tools.

When to Invest in Premium Monitoring Solutions

Premium stock monitoring tools offer advanced features that can significantly enhance your deal hunting capabilities. Consider investing in premium monitoring solutions when you’re serious about catching competitive deals and need features like real-time data, unlimited alerts, and sophisticated pattern recognition. Premium platforms are particularly valuable when monitoring high-value items or during high-volume shopping periods like Black Friday or Prime Day.

Premium tools justify their cost when they provide: significant savings through early access to deals, better technical support, and more reliable uptime. Many serious deal hunters use a combination of free and premium tools, leveraging free services for basic monitoring and premium platforms for high-priority items. Ultimately, the decision to invest in premium tools should be based on a cost-benefit analysis comparing the subscription price against your typical savings from early access to deals.

Setting Up Your First Stock Monitoring System

A well-configured stock monitoring system can be the difference between catching a deal and missing out. To get started, it’s essential to understand the components of an effective monitoring setup.

Step-by-Step Configuration Guide

To configure your stock monitoring system, begin by selecting a reliable platform that offers real-time data and customizable alerts. Next, define your monitoring criteria, such as specific stocks or market conditions. It’s crucial to set up alerts that notify you of significant changes in stock levels or price movements.

Customize your alert parameters based on the specific product category or retailer to avoid generic notifications. Organize and prioritize your alerts to ensure you respond to critical information promptly.

Common Setup Mistakes to Avoid

When setting up your stock monitoring system, there are several common pitfalls to avoid. Creating too many alerts at once can lead to alert fatigue, causing you to miss important notifications. Setting thresholds too sensitively can result in false positives, while setting them too conservatively might cause you to miss genuine deal opportunities.

Other mistakes include failing to test your notification system across all devices, not customizing alert parameters, and neglecting to review and refine your alert settings based on performance data. Having a clear strategy and action plan for when alerts trigger is also crucial for timely responses.

By avoiding these common mistakes and following a step-by-step configuration guide, you can establish an effective stock monitoring system that provides valuable information and helps you stay ahead in the deal hunting game.

Using Volume Spikes and Dips to Predict Deal Availability

Analyzing volume fluctuations can help predict when deals will go live. By monitoring changes in trading volume, you can gain insights into potential deal availability before they are officially announced.

How Unusual Trading Volume Relates to Upcoming Deals

Unusual trading volume often precedes price changes and official deal announcements. When volume exceeds normal trading ranges by a significant percentage, it indicates unusual activity that could signal upcoming promotions. Many advanced monitoring tools, like Stock Alarm which monitors over 65,000 assets, offer over 125 alert types, including volume spikes.

Setting up volume-based alerts is a sophisticated strategy for early deal detection. Configure your alerts to trigger when volume exceeds normal trading ranges. Consider setting graduated volume alerts at different thresholds to track the progression of unusual activity.

Setting Volume-Based Alerts for Early Deal Detection

To effectively set volume-based alerts, customize them based on the typical trading patterns of specific products. For early detection, set alerts for both sudden volume spikes and unusual dips. Use historical volume data to identify baseline patterns and seasonal variations, allowing you to set more accurate thresholds for your alerts.

Test and refine your volume-based alert system over time, adjusting thresholds based on successful predictions and false positives. Combine volume alerts with stock level monitoring for a comprehensive early warning system that catches different types of deal indicators.

Leveraging Technical Indicators for Deal Prediction

In the world of stock monitoring, technical indicators are the unsung heroes that help investors predict deal availability with greater accuracy. By analyzing various data points and patterns, these indicators provide valuable insights into potential stock movements and deal opportunities.

Key Technical Patterns That Signal Potential Deals

Certain technical patterns have proven to be reliable indicators of potential deals. These include trends in stock volume, price movements, and momentum shifts. For instance, an increase in stock volume alongside stable prices may signal an imminent deal. By identifying these patterns, investors can make more informed decisions about upcoming deals.

Key patterns to watch include: divergences between inventory levels and price stability, which can indicate a forthcoming promotion. Advanced platforms allow users to create custom indicators that combine multiple data points, making complex patterns easier to identify.

Combining Multiple Indicators for Higher Accuracy

While individual technical indicators can be useful, combining multiple indicators creates a more robust deal prediction system. This approach significantly improves accuracy by providing a more comprehensive view of market trends. Investors should look for confirmation across different types of indicators, such as volume, price, momentum, and trend, before making high-confidence predictions.

By developing a systematic approach to multi-indicator analysis and documenting successful combinations, investors can refine their strategy over time. Regular backtesting against historical deal data also helps improve prediction accuracy.

Mobile Apps for On-the-Go Stock Monitoring

Mobile apps have revolutionized the way we monitor stock levels, offering real-time updates and alerts that are crucial for predicting deal availability. With the right app, investors can stay ahead of the curve and make informed decisions on the go.

CNBC App for Real-Time Stock Alerts

The CNBC app provides real-time stock alerts and news, keeping investors up-to-date on market trends and stock performance. With its user-friendly interface, users can easily track their favorite stocks and receive notifications about significant changes.

Yahoo Finance Mobile for Comprehensive Stock Tracking

Yahoo Finance Mobile offers comprehensive stock tracking features, including real-time quotes, charts, and news. The app allows users to create a personalized watchlist and receive customizable notifications about the stocks they’re tracking.

Stock Alarm App for Customizable Notifications

The Stock Alarm app specializes in highly customizable notifications, offering over 125 alert types that can be tailored to detect specific inventory changes. It monitors over 65,000 assets across multiple categories, making it a comprehensive solution for tracking products from various retailers and market segments.

![]()

By utilizing these mobile apps, investors can stay on top of stock levels and market trends, making it easier to predict when deals will go live. Whether you’re a seasoned investor or just starting out, these apps provide the features and notifications needed to succeed in today’s fast-paced stock market.

Integrating Stock Monitoring with Inventory Management Systems

To maximize deal detection, integrating stock monitoring with inventory management is crucial. This integration enables businesses to leverage real-time data and advanced analytics, making informed decisions quickly. By combining these systems, companies can enhance their ability to predict and capitalize on deals.

Synchronizing Data Across Multiple Platforms

Synchronizing data across multiple platforms is essential for maintaining accurate and up-to-date inventory information. Real-time inventory tracking involves continuously updating and monitoring stock levels, providing accurate information at any given moment. By implementing API-based tracking solutions, businesses can automatically pull inventory data from multiple sources at regular intervals. This ensures that the information is always current and reliable.

Moreover, synchronizing data helps in identifying patterns and anomalies across different platforms, which can signal upcoming deals. By leveraging technologies like IoT, AI, and machine learning, businesses can gain deeper insights into their inventory levels and make data-driven decisions.

Automating Inventory Tracking for Seamless Deal Detection

Automating inventory tracking creates a seamless deal detection system that continuously monitors stock levels without requiring manual checks or updates. By implementing automated inventory tracking systems, businesses can recognize patterns and anomalies that might indicate upcoming deals. These systems can be programmed to alert users only when significant changes occur, streamlining the deal detection process.

Furthermore, automation enables businesses to monitor thousands of products simultaneously, scaling their deal detection capabilities. By integrating with advanced technologies and creating automated workflows, companies can respond quickly to potential deal opportunities and stay ahead of the competition.

Real-World Success Stories: How Effective Stock Monitoring Led to Major Deal Catches

Real-world success stories demonstrate the impact of effective stock monitoring on deal hunting. By leveraging advanced tracking systems, individuals can gain a significant edge in competitive markets.

The following case studies highlight the success of stock monitoring in different scenarios.

Case Study: Retail Product Launch Monitoring

A collector of limited edition sneakers developed a sophisticated stock tracking system that helped him secure multiple pairs from the highly coveted Nike x Off-White collaboration. His strategy involved monitoring inventory databases across multiple retailers and Nike’s own platform, looking for specific SKU numbers being added to backend systems before public release.

By tracking these early inventory additions, he could predict release dates and times with remarkable accuracy, often days before official announcements. The collector created custom alerts that would notify him via multiple channels the moment inventory status changed from “pending” to “available” in the retailers’ systems.

Case Study: Limited Edition Item Tracking

The success of his system was most evident during a surprise drop of Off-White Air Jordan 1s, where he secured two pairs while over 99% of interested buyers were unable to purchase. His technology included automated scripts that would check inventory status every few seconds during critical periods, providing near-instantaneous notifications.

This approach allowed him to purchase limited edition items within seconds of their release, before they sold out (typically within minutes). The data collected from these experiences has since been used to refine his methodology, including pattern recognition across multiple brands and retailers, identifying common inventory management practices that precede limited releases.

The success of this case study demonstrates how dedicated stock tracking can provide a significant advantage in highly competitive markets where products sell out almost instantly.

Future-Proofing Your Deal Hunting Strategy

To remain competitive in today’s fast-paced market, deal hunters must future-proof their strategies. This involves staying adaptable to evolving retail inventory management practices and technological changes.

Today’s most effective stock monitoring approaches may become less reliable as retailers implement measures to make their inventory systems less transparent or predictable. To mitigate this risk, it’s essential to diversify your monitoring tools and techniques.

Investing in continuous learning about new monitoring technologies and approaches helps you stay ahead of other deal hunters who rely on outdated methods. Building relationships with communities of like-minded deal hunters can provide early access to new strategies and tools as they emerge.

Developing custom solutions rather than relying solely on commercial platforms gives you more flexibility to adapt as retailers change their inventory management systems. Paying attention to broader market trends and technological developments helps anticipate how deal availability and detection might change in the future.

Today, emerging technologies like AI-driven prediction models and machine learning algorithms are likely to become standard tools for serious deal hunters in the near future. Ethical considerations should be part of your future strategy, as retailers may implement measures to prevent automated monitoring or purchasing that they consider disruptive.

The most successful long-term deal hunters will be those who balance technological tools with human insight, recognizing patterns and opportunities that automated systems might miss. By understanding the fundamental principles behind inventory management and deal cycles, you’ll remain competitive even as specific stock monitoring tools and platforms evolve.